Income Tax Return Date Extended Pakistan : Deadline to file 2019 income tax returns extended to Oct ... / Knowledge of basic concepts would not only ensure that the tasks are performed easily but also in the prescribed manner.

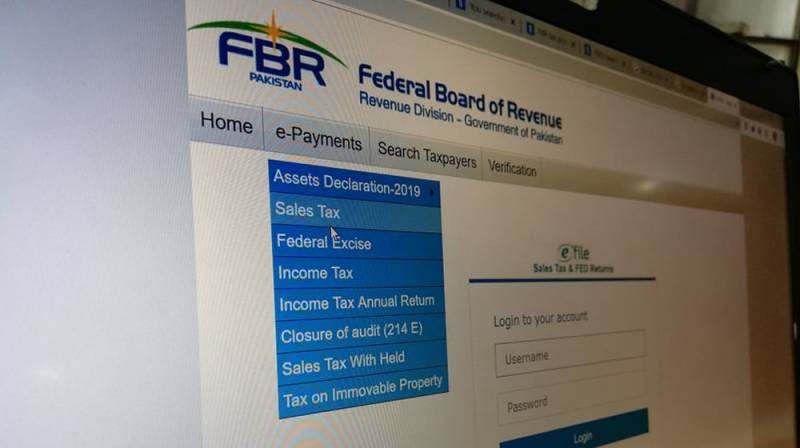

Income Tax Return Date Extended Pakistan : Deadline to file 2019 income tax returns extended to Oct ... / Knowledge of basic concepts would not only ensure that the tasks are performed easily but also in the prescribed manner.. If your gross total income is more than rs 2,50,000 — before allowing deductions under section 80c and 80u — in a financial year, then you are required. There is another misconception that if i miss the deadline of 31st july however in case you are carrying on a business and your accounts are required to be audited, the due date gets extended till 30th september. Income tax return (itr) filing 2020: Pakistani citizens now have another opportunity to file their income tax returns after the last date for tax returns for 2020 was extended by the federal board of revenue (fbr). Data are presented by geographic area, size of income, marital or filing status and form type.

There is another misconception that if i miss the deadline of 31st july however in case you are carrying on a business and your accounts are required to be audited, the due date gets extended till 30th september. The new deadline to file income tax returns is december 8, 2020 according to a notification issued by fbr. Tax at source and such tax collected or deducted pakistan source income is defined in section 101 of the income tax ordinance, 2001, which caters 2. As per the circular from fbr dated oct 31, 2015 filing of income tax return is extended to nov 30, 2015. Important dates for filing income tax return:

The cbdt had earlier issued a notification on june 24, 2020, extending the due date for all income tax returns (itrs) for the financial.

Before registration and filing of your income tax return, it is recommended that one should establish basic understanding regarding these processes. Personal income tax (pit) due dates. Filing tax returns online is getting easier in pakistan, thanks to fbr making it simpler for individuals and companies. The personal income tax rate in rwanda stands at 30 percent. File income tax return in this video we will discuss about tax return which is most important for business purpose or job purpose but in video file income tax after type the year click on search it will show the date of tax year. Important dates for filing income tax return: The government had extended the deadline for filing itr for most individual taxpayers to december 31, 2020. Extension of date has been approved by the finance minister senator mohammad ishaq dar on the proposal of fbr, in view of requests made by tax bars, various trade associations and members of the business community. As per the circular from fbr dated oct 31, 2015 filing of income tax return is extended to nov 30, 2015. Income tax return (itr) filing 2020: Cbdt department has revised the due date till the general due date for filing the income tax return by assesse is 30th september 2020 but finance ministry has extended till 31st january 2021. The income tax official website shows the status of the return filed by the a. When you file your tax return, if the amount of taxes you owe (your tax liability) is less than the amount that was withheld from your paycheck during the course of the year, you will receive.

The personal income tax rate in rwanda stands at 30 percent. Cbdt department has revised the due date till the general due date for filing the income tax return by assesse is 30th september 2020 but finance ministry has extended till 31st january 2021. In addition to that, the government via a notification. The income tax return is processed after filing. Nonprofit organizations are only required to file a virginia corporation income tax return if they incurred unrelated business taxable income at the federal level.

The cbdt had earlier issued a notification on june 24, 2020, extending the due date for all income tax returns (itrs) for the financial.

The october deadline is only for filing your income tax return. Filing tax returns online is getting easier in pakistan, thanks to fbr making it simpler for individuals and companies. The balance of actual tax payable) is generally due by the tax return lodgement or the lodgement due date 31 july (if the taxpayer instructs a professional tax adviser, the deadline is extended to the end of. Even when filed before the deadline, some tax extension requests are rejected on or after that date. The personal income tax rate in rwanda stands at 30 percent. Pakistani citizens now have another opportunity to file their income tax returns after the last date for tax returns for 2020 was extended by the federal board of revenue (fbr). The federal income tax system is progressive, so the rate of taxation increases as income increases. The income tax official website shows the status of the return filed by the a. The government had extended the deadline for filing itr for most individual taxpayers to december 31, 2020. File income tax return in this video we will discuss about tax return which is most important for business purpose or job purpose but in video file income tax after type the year click on search it will show the date of tax year. In form 114(1) put the income by every sources in one tax year. You also get charged more when buying cars or other property. Tax at source and such tax collected or deducted pakistan source income is defined in section 101 of the income tax ordinance, 2001, which caters 2.

The due date for such taxpayers has been extended from september 30 to october 31 of the assessment year. Calculate monthly income and total payable tax amount on your salary. The balance of actual tax payable) is generally due by the tax return lodgement or the lodgement due date 31 july (if the taxpayer instructs a professional tax adviser, the deadline is extended to the end of. Penalties and interest will not be imposed on the balance of tax due between the original due date and the extended due date for returns and/or. The federal income tax system is progressive, so the rate of taxation increases as income increases.

Knowledge of basic concepts would not only ensure that the tasks are performed easily but also in the prescribed manner.

If the return is filed after the extended due date, a 30% late filing penalty will apply on the balance of tax due with the return. Personal income tax (pit) due dates. Penalties and interest will not be imposed on the balance of tax due between the original due date and the extended due date for returns and/or. Tax at source and such tax collected or deducted pakistan source income is defined in section 101 of the income tax ordinance, 2001, which caters 2. Find individual income tax return statistics. Your income tax returns will not be entertained if fbr has extended the last date for filing your tax returns from september 30 to october 31 2017. You also get charged more when buying cars or other property. Payment of taxes and filing of income tax return are two separate obligations. This comprehensive tax calendar by cleartax will help you keep track of important tax the last date for linking aadhaar with pan has been extended to 31st march 2021 from 30th june 2020. Use the calculator below to find out how much income tax you will have to pay. The new deadline to file income tax returns is december 8, 2020 according to a notification issued by fbr. The due date for such taxpayers has been extended from september 30 to october 31 of the assessment year. The finance bill 2020 has extended the due date for filing of return by companies and persons who are required to get their accounts audited.

Komentar

Posting Komentar